The Thorough Help guide Flipping Real Estate Property: Techniques, Challenges, and Possibilities

Release:

Flipping real estate has acquired widespread popularity being a lucrative expenditure technique, captivating both seasoned brokers and newcomers alike. The allure of buying distressed attributes, improving them, and selling to get a considerable income is undeniable. Even so, effective real estate property turning requires more than just a enthusiastic eyes for potential it demands a strategic strategy, careful planning, plus a thorough understanding of industry dynamics. This extensive manual delves into the particulars of turning real estate, investigating successful tactics, prospective obstacles, and the myriad options open to traders.

Understanding Real Estate Flipping:

Real estate property flipping entails purchasing properties, typically those in need of maintenance or reconstruction, boosting them, and selling them at the better value. The goal is usually to acquire a quick turnaround and capitalize on the improved home worth submit-reconstruction. Unlike buy-and-keep tactics, which give attention to long-term appreciation and rental cash flow, turning is focused on simple-phrase gains and rapid financial transaction periods.

The Flipping Method:

Finding the Right House: Successful turning begins with identifying the correct home. Traders often target distressed qualities, home foreclosures, or homes looking for considerable improvements. Key options include real estate auctions, banking institution-owned or operated components (REOs), and distressed seller sale listings.

Conducting Research: Thorough homework is crucial. This requires evaluating the property's issue, estimating fix and restoration costs, and examining comparable income (comps) in the area to look for the prospective resale benefit. Understanding local marketplace tendencies and demand is also essential.

Getting Loans: Funding a flick can be done through different signifies, which include personalized price savings, difficult funds loans, personal loan providers, or conventional home loans. Challenging dollars personal loans, even though more expensive, are popular due to their mobility and faster authorization processes.

Renovating the Property: Restoration may be the heart in the turning process. Traders should concentrate on cost-effective upgrades that significantly increase the property's benefit. This might include kitchen and bathroom remodels, floor coverings upgrades, fresh paint, and entrance charm advancements. Controlling real estate wholesaling step by step reconstruction timelines and spending budgets is essential to enhancing profits.

Advertising and marketing and Selling: After refurbishments are complete, the house shows up available for purchase. Effective marketing tactics, such as professional photography, staging, and itemizing on numerous platforms, are essential to get potential buyers. Partnering with a qualified realtor can how to become a real estate wholesaler assist in faster income and much better negotiation outcomes.

Benefits of Flipping Real-estate:

High Potential Profit: Turning real estate property can produce substantial income within a relatively short time period, particularly in markets with increasing property ideals and high desire.

Hands and wrists-On Expenditure: As opposed to passive expense tactics, flipping will allow traders to actively engage along the way, from property selection to reconstruction and purchase, supplying a feeling of handle and fulfillment.

Industry Adaptability: Flipping permits buyers to quickly adjust to industry situations, capitalizing on quick-term developments and options which may not position with long-term purchase methods.

Talent Improvement: Flipping hones various expertise, which include residence analysis, task management, negotiation, and industry evaluation, that are useful for larger real estate committing.

Challenges of Flipping Property:

Marketplace Unpredictability: Real-estate trading markets could be unforeseen, and sudden downturns can affect reselling worth and profitability. Remaining well informed about market styles and monetary signals is vital to minimize hazards.

Reconstruction Hazards: Unpredicted concerns during renovations, including structural issues or code infractions, can cause finances overruns and project slow downs. Comprehensive residence assessments and contingency planning are essential.

Financing Charges: High-rates on hard dollars financial loans and other brief-term loans alternatives can try to eat into profits in the event the residence fails to offer rapidly. Powerful fiscal management and expense handle are essential.

Legitimate and Regulatory Conformity: Flipping qualities needs adherence to several local, condition, and national restrictions, which include creating requirements, zoning legal guidelines, and make it possible for demands. Failing to abide can result in fines and authorized issues.

Methods for Effective Flipping:

Thorough Market Research: In-depth market research may be the foundation of profitable flipping. Comprehending nearby marketplace dynamics, residence ideals, and shopper choices will help identify lucrative options and get away from overpaying for properties.

Accurate Charge Estimation: Precisely estimating restoration expenses and possible reselling benefit is crucial. Working with seasoned installers and ultizing thorough task ideas will help handle expenses and avoid spending budget overruns.

Efficient Task Administration: Powerful venture managing makes certain refurbishments are accomplished punctually and within finances. Standard advancement tracking, crystal clear conversation with contractors, and adaptability in responding to issues are necessary components.

Exit Approach Planning: Having a obvious get out of method, no matter if selling the property rapidly or booking it out in the event the market conditions are unfavorable, offers a protection net and makes certain versatility in replying to market modifications.

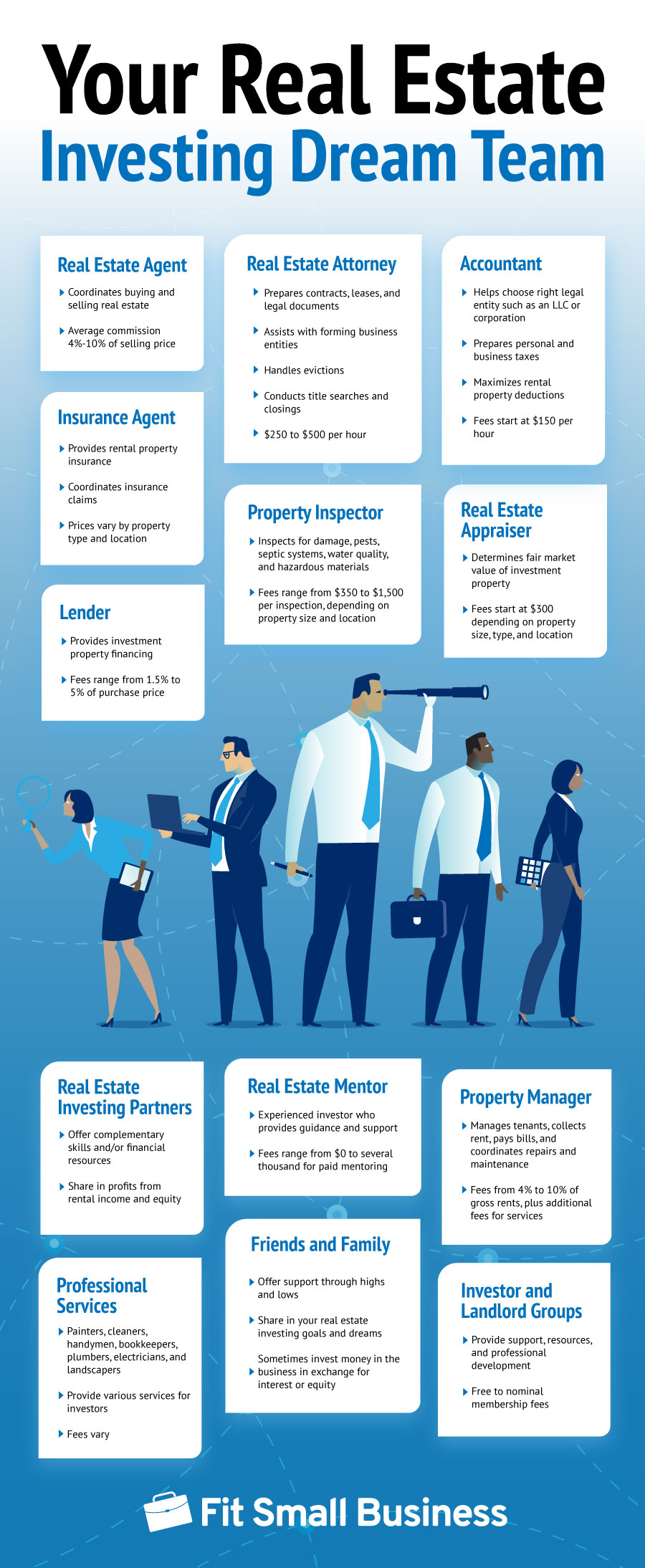

Networking and Partnerships: Building a network of dependable companies, real estate agents, loan companies, and also other pros offers important assets, assist, and opportunities for partnership.

Prospects in actual Real estate Flipping:

Promising Market segments: Discovering and making an investment in emerging markets with powerful growth prospective can result in important revenue. These trading markets often times have decrease admittance charges and better admiration prices.

Distressed Qualities: Distressed qualities, including home foreclosures and short product sales, can be obtained at substantial savings, offering ample place for profit after refurbishments.

High end Flips: Higher-end attributes in well-off neighborhoods can yield large profits, although they require larger investment capital purchases and a eager understanding of deluxe market place developments.

Natural Refurbishments: Including sustainable and energy-successful characteristics in renovations can attract environmentally conscious customers and potentially be eligible for a income tax rewards or rebates.

Technologies Incorporation: Leveraging technological innovation, like digital trips, internet marketing, and venture control software, can improve performance, attract technical-savvy buyers, and enhance the turning method.

Conclusion:

Turning real estate offers a compelling path for investors looking for speedy profits and active engagement inside the residence market place. Although the potential for high revenue is significant, it includes its share of problems and hazards. Achievement in flipping requires a strategic technique, meticulous preparing, and a serious comprehension of market dynamics. By performing detailed research, dealing with makeovers successfully, and staying versatile to showcase circumstances, traders can understand the intricacies of flipping and exploit the opportunities it presents. Regardless of whether you're a skilled trader or possibly a newcomer to real estate community, turning delivers a dynamic and gratifying pathway to economic progress and expenditure success.